Digital assets face a deeper, more mature market in the coming year amid clearer regulatory frameworks, improved access channels, and a growing recognition of their distinctive role in diversified portfolios, according to a new report.

After a strong rally in early 2025, Bitcoin fell more than 30% in October following an escalation of the trade spat between the United States and China, which triggered a wave of liquidation of leveraged positions, Fidelity International says in its 2026 outlook report on digital assets. Over a trillion dollars has been wiped off crypto market valuations in the succeeding weeks.

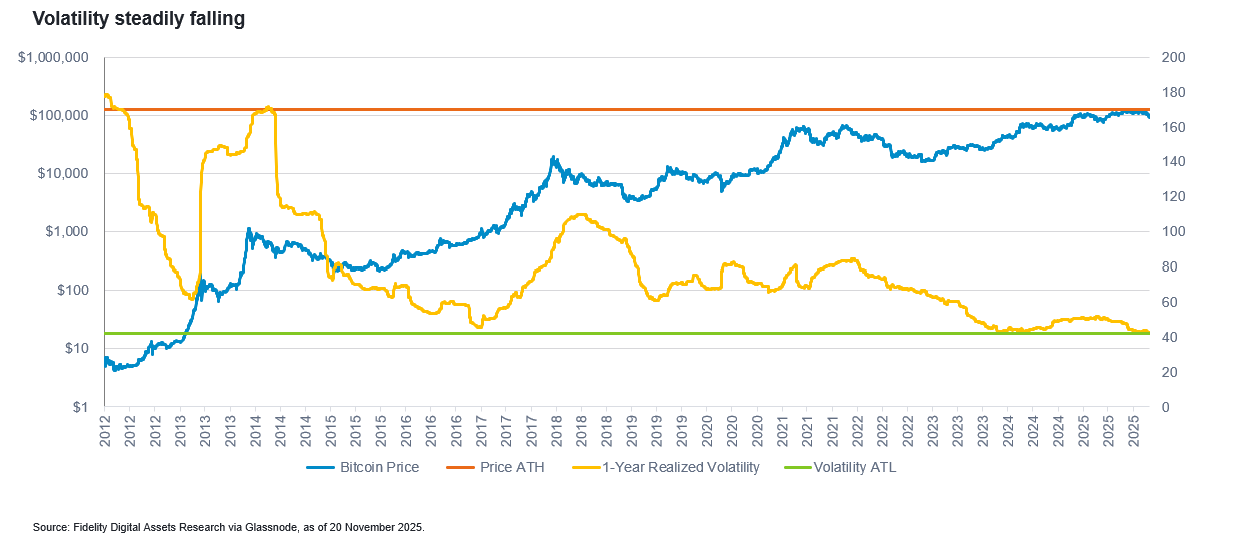

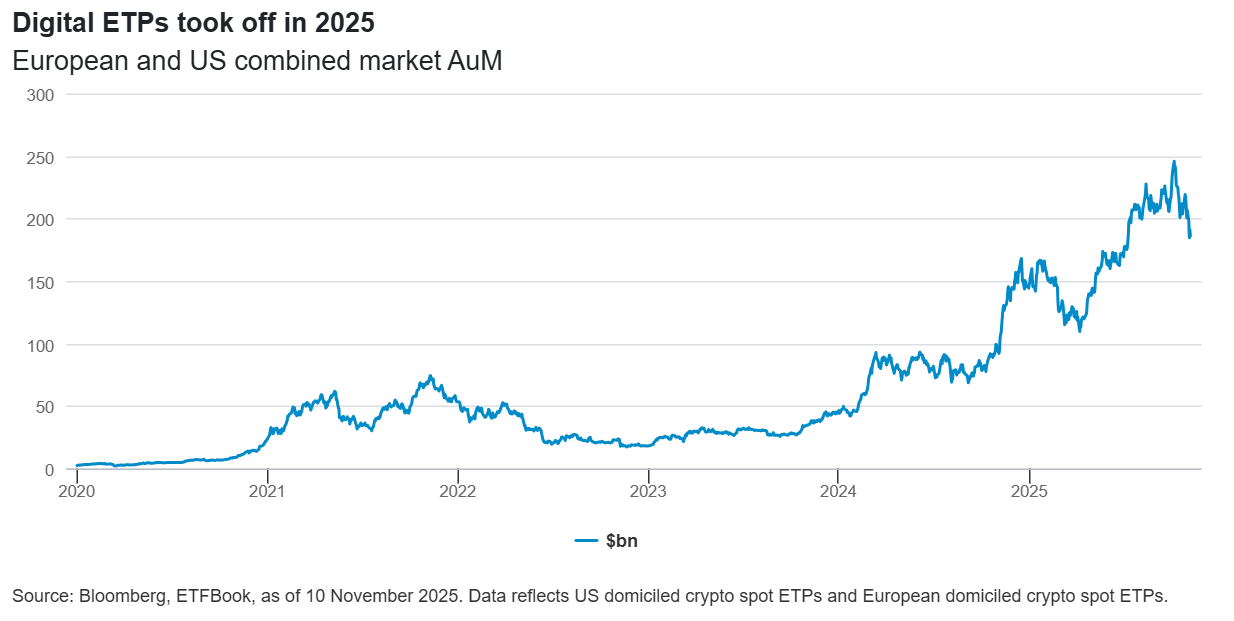

“While there has been volatility, behind those big numbers, the move on Bitcoin itself was both less damaging and relatively modest in a historical context,” says Giselle Lai, associate director, digital assets, at Fidelity International. “The market is deeper than it was. Institutional participation is growing, ranging from corporate treasuries and private banks to sovereign wealth funds and advisers. The market’s capitalization now exceeds US$1.5 trillion, with spot Bitcoin ETFs emerging as a key access point.

Bitcoin derives its growing relevance from its core characteristics – scarcity, neutrality, and independence from sovereign control, according to Fidelity. “In a world marked by geopolitical tension and currency debasement fears, Bitcoin’s non-sovereign, fixed-supply structure offers an alternative store of value,” Lai says. “With no earnings or cash flows, price dynamics mirror global liquidity and sentiment, making it both a reflection of macro trends and, for some, a hedge against political instability.”

Lai believes the next phase of Bitcoin’s evolution will focus on greater utility, moving beyond passive holding and speculation to roles in collateralization, lending, and derivatives. “The October correction and subsequent derivatives liquidations underscored how quickly 24/7 markets can unwind and reinforced the importance of institutional-grade risk management and discipline,” she adds.

According to a recent survey by Fidelity International, close to a quarter of retail investors already hold digital assets and more than half plan to increase allocations within a year. The advent of spot crypto exchange-traded funds ( ETFs ) has helped drive retail interest in the asset class. Such ETFs have gone beyond Bitcoin to track Ethereum and Solana, for instance, which power decentralized applications and smart contracts, addressing different use cases within the broader blockchain landscape.

Tokenized funds are also gaining significance in the market, redefining investor access, bringing together yield, liquidity and true on-chain exposure, notes Emma Pecenicic, head of digital propositions and partnerships, Asia-Pacific ex-Japan distribution at Fidelity.

“Yet the opportunity comes with its own challenges in tokenized funds. Most current models simply replicate existing funds digitally, rather than reimagining them for a world of 24/7 trading and instant settlement. To unlock the market’s full potential, we need to move from ‘digital twins’ to truly ‘digital-native’ fund structures,” she says.

Fidelity believes the digital asset ecosystem is maturing, marked by greater institutional confidence, product innovation, and regulatory evolution. “The conversation has shifted from ‘what if’ to ‘how’: how to embed digital assets within the mainstream investment toolkit with discipline, transparency, and purpose. That should draw more interest and more capital in 2026,” Pecenicic says.